Plan It by American Express Ranks Highest in Buy Now Pay Later Customer Satisfaction for Second Consecutive Year

More Consumers Using Buy Now Pay Later, J.D. Power Finds

Media Relations Contacts

Geno Effler, J.D. Power; West Coast; 714-621-6224; media.relations@jdpa.com

John Roderick; East Coast; 631-584-2200; john@jroderick.com

Buy Now Pay Later (BNPL) services saw continued growth in the number of consumers using them, with the highest usage among consumers from Generations Y1 and Z. According to the J.D. Power 2025 U.S. Buy Now Pay Later Satisfaction Study,? released today, the number of consumers using BNPL products grew significantly year over year, especially during the holiday season.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20250227435262/en/

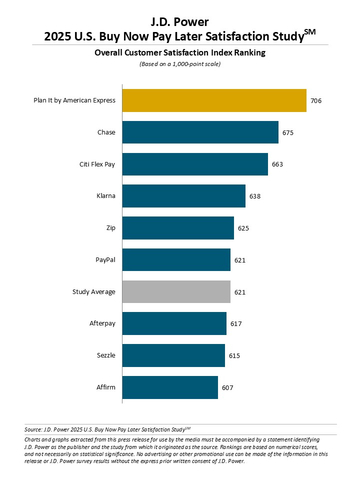

J.D. Power 2025 U.S. Buy Now Pay Later Satisfaction Study? (Graphic: Business Wire)

“The BNPL segment has undoubtedly grown in popularity, with more customers using these services than ever before,” said Sean Gelles, senior director of banking and payments at J.D. Power. “That’s been especially true around seasonal periods of higher spending, such as the holidays. Card-based BNPL products continue to lead the charge on satisfaction, as issuers are leveraging their existing brand awareness and equity to retain would-be defectors.”

Following are some of the key findings of the 2025 study:

- Generations Y and Z turn to BNPL: Consumers that belong to Gens Y and Z are utilizing BNPL services the most. Nearly half (42%) of them used BNPL vs. 21% of consumers from other generations. In the study’s final wave—which included the 2024 holiday season—more consumers from Gen Z said they used BNPL instead of credit cards, which was the first such occurrence in the study’s history. These customers are particularly driven to find the most competitive repayment terms and are finding BNPL products to be an attractive alternative to credit cards.

- Gen Y consumers most satisfied: Customers that belong to Gen Y have the highest overall satisfaction with their BNPL lender (627) among generational cohorts. Gen Y customers cite the convenience, cost, a recommendation from a family member and trust with the brand as reasons that helped them choose their BNPL lender. Despite lower utilization (29%), Gen X customers gave BNPL the second-highest satisfaction marks (620). Gen Z was third (617).

- Card-based BNPL products perform well: Consumers continue to give higher marks to card-based BNPL services. The top three brands in the study are card-based solutions offered by legacy card issuers. Consumers have high satisfaction on most dimensions such as digital account management capabilities; security; and acceptance. They may also benefit from legacy brand affinity.

- Overall satisfaction significantly dips for two brands: The two brands that saw the largest decline in satisfaction year over year were Zip and PayPal. These brands saw a 30-point and 35-point drop in satisfaction, respectively, which contributed to the 13-point decline in the study’s overall satisfaction.

Study Ranking

Plan It by American Express ranks highest in BNPL satisfaction, with a score of 706. Chase (675) ranks second and Citi Flex Pay (663) ranks third.

The J.D. Power U.S. Buy Now Pay Later Satisfaction Study, now in its third year, is part of a group of four interconnected syndicated studies focused on the various forms of POS payment options. Its sister studies include the POS Choice Satisfaction Study;? Debit Card Satisfaction Study;? and Digital Wallet Satisfaction Study.? The 2025 Buy Now Pay Later Satisfaction Study captured the responses of 4,343 customers, and was fielded from February through January 2025.

For more information about the U.S. Consumer POS Payment Program, visit https://www.jdpower.com/business/consumer-payments-satisfaction-studies.

See the online press release at http://www.jdpower.com/pr-id/2025015.

About J.D. Power

J.D. Power is a global leader in consumer insights, advisory services, and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 55 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power has offices in North America, Europe and Asia Pacific. To learn more about the company's business offerings, visit JDPower.com/business. The J.D. Power auto-shopping tool can be found at JDPower.com.

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info

1 J.D. Power defines generational groups as Pre-Boomers (born before 1946); Boomers (1946-1964); Gen X (1965-1976); Gen Y (1977-1994); and Gen Z (1995-2007).

View source version on businesswire.com: https://www.businesswire.com/news/home/20250227435262/en/