martini.ai Introduces AI-Powered Scenario Builder to Transform Portfolio Risk Analysis

Media Contact

Dottie O’Rourke

TECHMarket Communications, for martini.ai

650-344-1260

martini@techmarket.com

martini.ai, the leading AI-driven credit intelligence platform, has unveiled its latest innovation, Scenario Builder, a powerful new feature that allows financial professionals to model economic events and stress test portfolios in real time.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20250305433199/en/

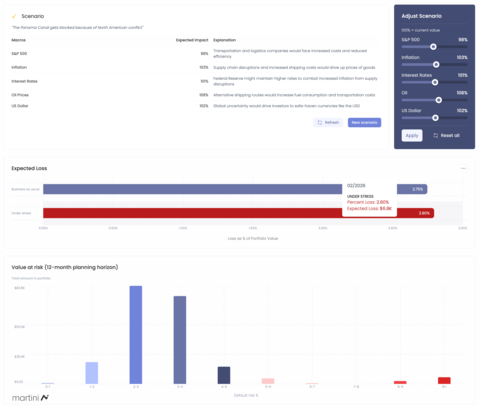

martini.ai Scenario Builder (Graphic: Business Wire)

Growing Risks Demand Proactive Portfolio Management

Market risks are not only increasing in number but also growing in their potential to disrupt portfolio performance at an unprecedented scale. Global credit markets have seen heightened volatility due to rising interest rates, geopolitical instability, and rapid shifts in economic policy. Traditional risk assessment methods often fail to capture the real-time interconnectedness of these macroeconomic forces, leaving credit investors exposed to unexpected downturns.

Scenario Builder enables private credit investors, asset managers, and lenders to stay ahead of these challenges by translating uncertainty into actionable insights, allowing them to stress test portfolios and adjust risk exposure before market shocks occur.

With Scenario Builder, users can input hypothetical events — such as geopolitical tensions, interest rate hikes, or market crashes — and instantly see precise, data-driven projections of their impact on private credit portfolios. The feature dynamically adjusts key macroeconomic variables, including inflation, oil prices, the strength of the U.S. dollar, and the S&P 500, to simulate real-world financial stress. Users can then refine these assumptions and view the direct effects on expected losses and default risk in their portfolio.

“Risk isn’t static, and neither should portfolio analysis be,” said Rajiv Bhat, CEO of martini.ai. “With Scenario Builder, our users can proactively prepare for any market-moving event, whether it’s a deepening trade war, a banking crisis, or an AI investment boom. It’s about turning uncertainty into strategic advantage.”

How It Works

- Build Your Own Scenario – Users can type in a scenario (e.g., “China imposes new tariffs on U.S. tech”) and let the AI generate potential macroeconomic shifts.

- Adjust Macroeconomic Factors – Fine-tune key drivers such as S&P 500 performance, inflation, oil prices, interest rates, and the U.S. dollar to reflect different possible outcomes.

- Analyze Portfolio Impact – Instantly visualize expected loss percentages and default risk across different industries and companies.

The feature integrates seamlessly with martini.ai’s existing credit intelligence platform, providing a comprehensive risk assessment tool that adapts to an ever-changing economic landscape.

Empowering Smarter Credit Decisions

With markets facing heightened volatility, Scenario Builder provides a data-driven approach to stress testing portfolios, helping asset managers, lenders and credit investors make better-informed decisions. This feature allows users to quantify downside risks, explore worst-case scenarios, and build resilience into their investment strategies.

About martini.ai

martini.ai is an AI-driven fintech company specializing in credit analytics for institutional investors, risk managers, and corporate financial teams. The company continues to set the standard for AI-driven financial intelligence for corporate credit, giving clients the tools they need to stay ahead in an unpredictable world. By leveraging machine learning and sophisticated data models, martini.ai delivers real-time insights that drive smarter decision-making. Headquartered in Palo Alto, California, the company serves clients worldwide with cutting-edge solutions that streamline credit risk evaluation and portfolio management. For more information, please visit www.martini.ai, and follow the company on LinkedIn.

All brands and solution names are trademarks or registered trademarks of their respective companies.

Tags: martini.ai, Scenario Builder, Rajiv Bhat, credit analysis, credit intelligence, institutional investors, credit investors, risk managers, asset managers, risk assessment, fintech, credit risk, portfolio management, portfolio monitoring, financial services, private credit, private lenders

View source version on businesswire.com: https://www.businesswire.com/news/home/20250305433199/en/