Hourly wage growth for workers starts the new year below three percent for first time since 2021

Job Growth in U.S. Small Businesses Continues the Pace Seen in the Back Half of 2024

Media Contacts

Tracy Volkmann

Paychex, Inc.

Manager, Public Relations

(585) 387-6705

tvolkmann@paychex.com

@Paychex

Emily Walsh

Highwire Public Relations

Account Executive

(914) 815-8846

paychex@highwirepr.com

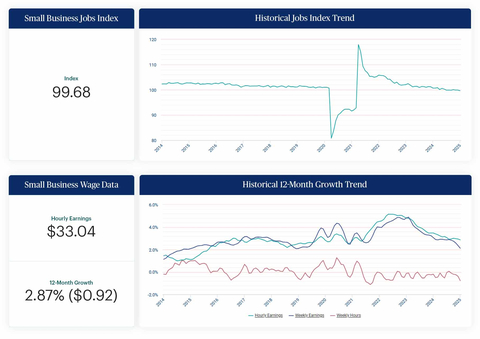

According to the Paychex Small Business Employment Watch, the pace of job growth in U.S. small businesses with fewer than 50 employees remained slightly below 100 in January, consistent with the last six months of 2024. Meanwhile, hourly earnings growth for workers decelerated to 2.87% in January, marking its first time starting the year below three percent since 2021.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20250204239786/en/

According to the Paychex Small Business Employment Watch, the pace of small business job growth remained slightly below 100 in January, consistent with the last six months of 2024. (Graphic: Business Wire)

“Small businesses successfully navigated an evolving economic landscape, challenging labor market, and an election in 2024,” said John Gibson, Paychex president and CEO. “Last year delivered moderate job growth and continued moderation in wage inflation. Entering 2025, small business owners are more optimistic, but as of January that optimism hasn’t translated into accelerated job growth when compared to the last quarter of 2024.”

“With cooling wage inflation and increased optimism, the labor environment should position small businesses for continued moderate job growth in the new year,” Gibson added.

Jobs Index and Wage Data Highlights

- The national small business jobs index was 99.68 in January.

- Hourly earnings growth (2.87%) continued to moderate in January, as one-month annualized growth has been below three percent since May 2024.

- Weekly earnings growth has quickly decelerated in recent months to 2.12% in January 2025, marking its lowest level since January 2019 (2.10%). Similarly, weekly hours worked growth decreased further in January (-0.77%) to its lowest level since October 2021.

- With an index level of 100.23 in January, the Midwest remained the top region for employment growth for the eighth consecutive month. Leading the region, Indiana’s index gained 2.02 percentage points (101.67) to reclaim the top rank among states, a position the Hoosier State held for half of 2024.

- Of the four California metros analyzed, Los Angeles was the only area to report its pace of job growth slowing in January, possibly due to the impacts of significant wildfires.

- Education and Health Services (101.72) continued as the top sector for job growth for the eighth consecutive month, while the rate of job growth in the Manufacturing (97.13) industry slowed 1.12 percentage points to its lowest level since March 2021.

More Information

For more information about the Paychex Small Business Employment Watch, visit the website and sign up to receive monthly Employment Watch alerts.

*Information regarding the professions included in the industry data can be found at the Bureau of Labor Statistics website.

About the Paychex Small Business Employment Watch

The Paychex Small Business Employment Watch is released each month by Paychex, Inc. Focused exclusively on businesses with fewer than 50 workers, the monthly report offers analysis of national employment and wage trends and examines regional, state, metro, and industry sector activity. Drawing from the payroll data of approximately 350,000 Paychex clients, this powerful industry benchmark delivers real-time insights into the small business trends driving the U.S. economy. The jobs index is scaled to 100, which represents no year-over-year change in job growth among same store businesses. Index values above 100 represent new jobs being added, while values below 100 represent jobs being lost.

About Paychex

Paychex, Inc. (Nasdaq: PAYX) is an industry-leading HCM company delivering a full suite of technology and advisory services in human resources, employee benefit solutions, insurance, and payroll. The company serves more than 745,000 customers in the U.S. and Europe and pays one out of every 12 American private sector employees. The more than 16,000 people at Paychex are committed to helping businesses succeed and building thriving communities where they work and live. To learn more, visit paychex.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20250204239786/en/