Revenue cycle leaders need creative, data-driven solutions to counteract lower payment rates by patients and higher denial rates from payors as trends from 2024 expected to continue

Healthcare Providers Facing Stiff Headwinds on Revenue Cycle Performance, Kodiak Solutions Data Show

For Media:

Vince Galloro

(312) 625-2137

vince.galloro@sunrisehlth.com

Lower collection rates from insured patients and higher initial denial rates formed significant financial headwinds for hospitals, health systems and medical providers in 2024, according to Kodiak Solutions’ proprietary data.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20250227049715/en/

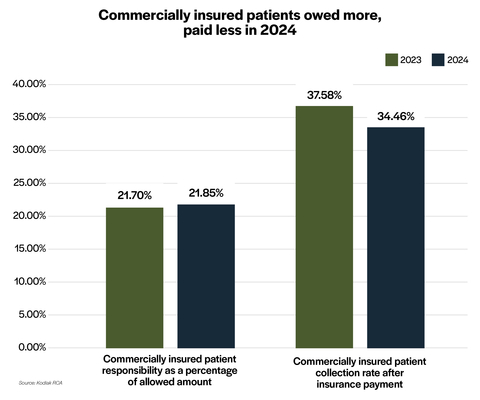

In 2024, the collection rate for providers from commercially insured patients fell more than 3 percentage points, from 37.6% in 2023 to 34.4%, according to Kodiak’s data. (Graphic: Business Wire)

The collection rate for providers from commercially insured patients fell more than 3 percentage points, from 37.6% in 2023 to 34.4% in 2024, according to Kodiak’s data. The lower collection rate came as patients were responsible for a slightly higher percentage of allowable charges.

Provider organizations have offset some of the impact of a lower patient collection rate by improving point-of-service (POS) collections and collection on bad debt, Kodiak data indicate.

For the fourth straight year, medical providers also faced higher initial claim denials. Payors initially denied 11.8% of claims in 2024, up from 11.5% in 2023 and a 15.7% increase from 2020. The rate of final denials of claims held steady at 2.8% comparing 2024 to 2023, although the final denial rate is 16.7% higher than in 2020.

The initial denial rate, according to Kodiak data, is being driven by commercial health plans and Medicare Advantage plans, which are primarily operated by commercial health insurance companies. Both payor categories saw their initial request for information (RFI) denials increase from 2023 to 2024 and they were the top payer categories in this metric in both years, the data showed.

Using all the tools in the box

Revenue cycle leaders at hospitals, health systems and medical practices are employing a wide range of strategies and tactics to counteract these headwinds, said Matt Szaflarski, Vice President, Revenue Cycle Intelligence for Kodiak Solutions.

“While our data suggest that these headwinds continue to gather strength, I am encouraged by the conversations that my colleagues and I are having with revenue cycle leaders across the country,” Szaflarski said. “These leaders are using revenue cycle data to pinpoint problem areas and then developing creative solutions that will drive their revenue cycle performance in 2025.”

Examples include:

- Improving patient education and communication about health plan benefit design and the overall financial experience.

- Furthering integration of their clinical departments with revenue cycle operations.

- Inserting stronger language in payor contracts and service level agreements to limit pre-payment audits and denials.

To learn more about the data and insights Kodiak Solutions can provide to benchmark your revenue cycle performance, contact Szaflarski at (463) 270-8123.

About Kodiak Solutions

Kodiak Solutions is a leading technology and tech-enabled services company that simplifies complex business problems for healthcare provider organizations. For nearly two decades as a part of Crowe LLP, Kodiak created and developed our proprietary net revenue reporting solution, Revenue Cycle Analytics. Kodiak also provides a broad suite of software and services in support of CFOs looking for solutions in financial reporting, reimbursement, revenue cycle, risk and compliance, and unclaimed property. Kodiak’s 450 employees engage with more than 2,000 hospitals and 275,000 practice-based physicians, across all 50 states, and serve as the unclaimed property outsourcing provider of choice for more than 2,000 companies. To learn more, visit our website.

View source version on businesswire.com: https://www.businesswire.com/news/home/20250227049715/en/

"Revenue cycle leaders are using data to pinpoint problem areas and then developing creative solutions that will drive their revenue cycle performance in 2025." -- Matt Szaflarski, Kodiak Solutions VP of Revenue Cycle Intelligence